Growth Capital Strategy

Growth Equity

Partnering with experienced and motivated entrepreneurs with strong conviction in their businesses to build companies with clear competitive advantages.

Investment Strategy

We look to partner with experienced and motivated entrepreneurs that have strong conviction in their businesses and built companies with clear competitive advantages, shown an efficient use of capital, and share attractive investment characteristics.

We have established expertise supporting companies at this stage of growth, which has led to successful exits to leading strategics, larger financial sponsors, and IPOs/SPACs.

Investment Criteria

- North America lower-middle market

- $10 – $75 million initial investments

- Maintain discipline: return “of” capital, before return “on” capital

- Minority & control positions

- Primary & secondary positions

Structure

- Preferred equity

- Debt with warrants

- Convertible debt

- Common

Company Profile

- $10 – 75M+ revenue ($8 million + recurring)

- 20%+ annual growth

- Attractive & sustainable margins

- EBITDA+ or path to profitability

- Seasoned management with meaningful ownership

- Measurable ROI

- World class customers

Target Industries

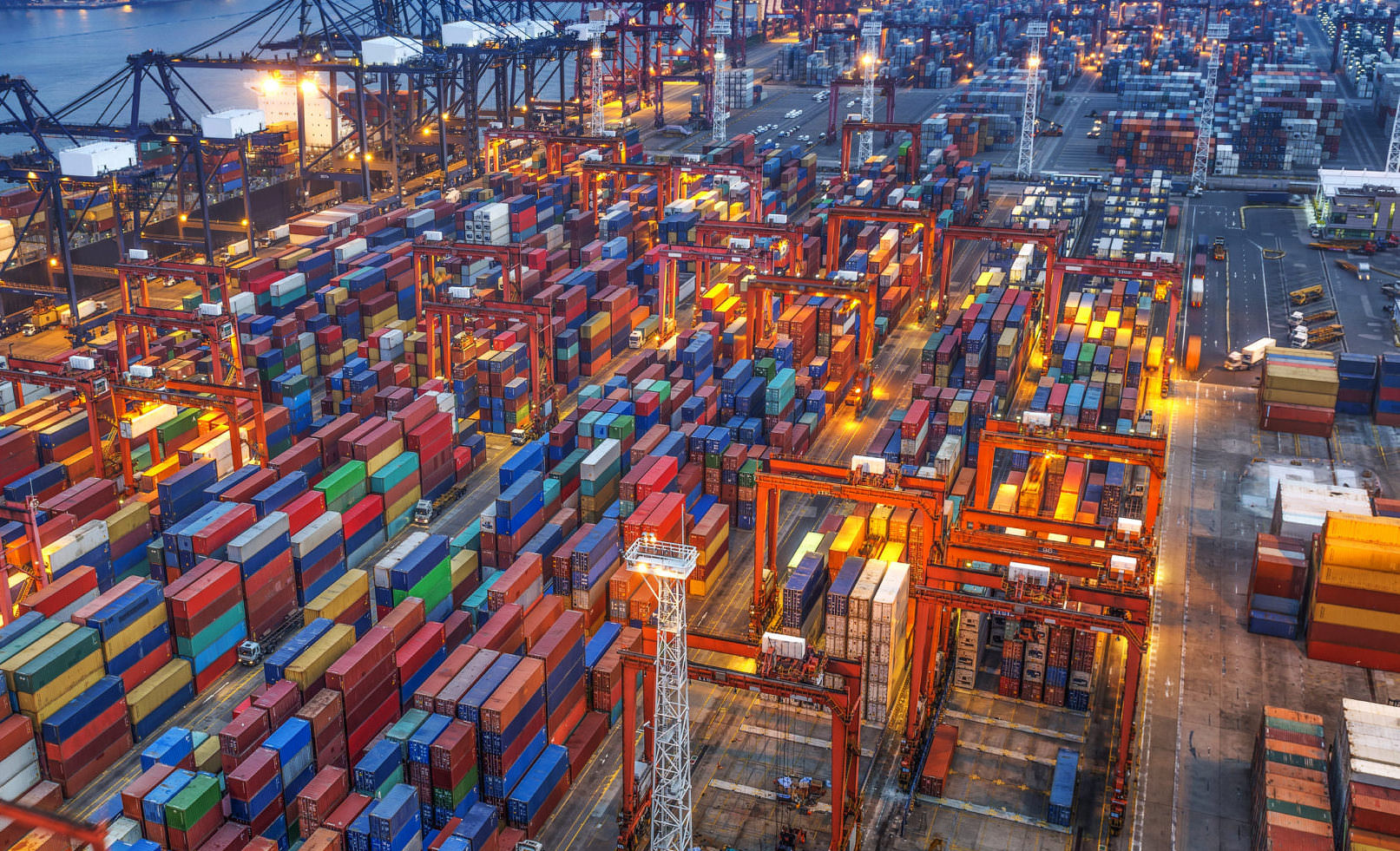

- Supply chain & logistics

- Media & telecom

- Business process automation

- Financial technology

- Healthcare

- Security, compliance & infrastructure

Recent News

-

Kayne Anderson Real Estate Appoints Lee Levy as Senior Managing Director and Head of Real Estate DebtReal Estate

-

Kayne Anderson Announces Lee Levy Has Joined Its Real Estate ArmReal Estate Wall Street Journal Pro

-

Energy Infrastructure Update – June 2024Energy Infrastructure