Real Estate Debt

Alternative Real Estate Lending

Kayne Anderson Real Estate’s lending focuses on alternative sectors — student housing, multifamily housing, seniors housing, medical office, self storage, and industrial sectors.

Contact the Team

Please reach out to realestatelending@kayneanderson.com to inquire about financing.

Kayne Anderson Real Estate Direct Lending Program

Loan Amount

- Senior Mortgage: $50 million – $500+ million

- Mezzanine/Preferred Equity: $20 million – $200+ million

Loan Term

- 2-7 years including extensions

Property Types

- Multifamily, Student housing, Seniors housing, Medical office, Storage, Select Industrial

Loan Purpose

- Construction, value add, bridge, stabilized, and term loans

Loan Types

- Senior Mortgage, Mezzanine and Preferred Equity (including Preferred Equity behind Agency loans), and Note Purchase

Markets

- High value and growth markets across the US

LTC/LTV

- 60% – 80%

Recourse

- Non-recourse with standard carveouts

- Completion and carry guaranty required for construction loans

Pricing

- Senior Mortgage: SOFR + 2.75% – 5.50% (fixed rate may be available)

- Mezzanine/Preferred Equity: 12%+ coupon (fixed or floating) with flexible payment structures

Origination Fee

- 1.0%

Exit Fee

- 0% – 0.50%

Prepayment

- 12 – 24 months of minimum interest

Amortization

- Interest only

Terms and fees are general/indicative and may vary

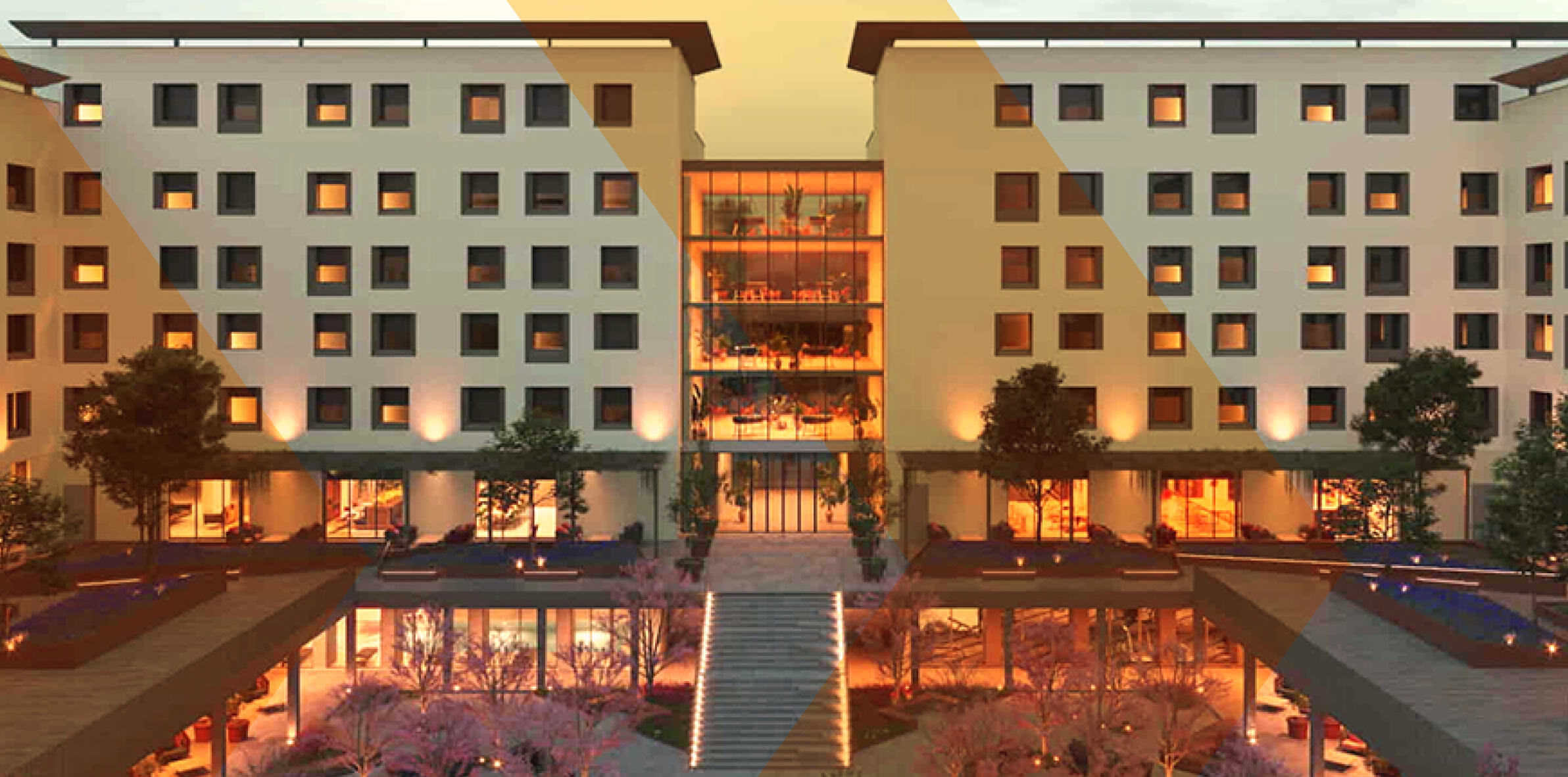

Hub Speedway, Tucson, AZ

Grand Station, Miami, FL

Life Storage, New York City, NY